RenewEconomy

Do you remember the predictions of solar industry consolidation?

Predictions that eventually the market would consolidate from 4000 businesses to four or forty major solar companies serving the Australian market?

The logic seemed sound: the solar market was contracting year on year from 2012-2016, and the residential backbone was eroding even faster.

Along with it, system prices kept falling, meaning revenue was plummeting even as operating costs and red tape rose. America had seen the market share of the top player exceed 40% – wasn’t this Australia’s destiny?

Wasn’t Origin or AGL or SunEdison or True Value Solar going to sweep away all the small businesses? Force the exit of smaller players either by out-competing them or by buying them out?

What was a small business to do, except grimly hold on and hope that the others went bust before them?Grimly holding on meant matching your competitors prices at a level that was absurdly and unsustainably low.

Or a small business could pray each night that a buyer would come along. Apart from a couple of fellas who got lucky – selling their business at the height of the solarcoaster and returning to solar in 2017’s boom year, most that discussed selling up discovered their business value was practically worthless.

The value of their pipeline was more than offset by the potential liability of past installations, leaving business processes being the only value in a solar company – processes that weren’t particularly robust, easy enough to recreate, and processes that a buyer would find difficult to integrate into their own.

Now there have been plenty of businesses that have gone bust in the past 5 years. This would suggest a degree of industry consolidation has occurred through attrition.

However it seems that an equal number of businesses have been started.

The charts below prove that industry consolidation has not occurred. Indeed, SunWiz’s market assessment demonstrates that the opposite has occurred: the solar industry is now more competitive than ever, with no single company able to dominate.

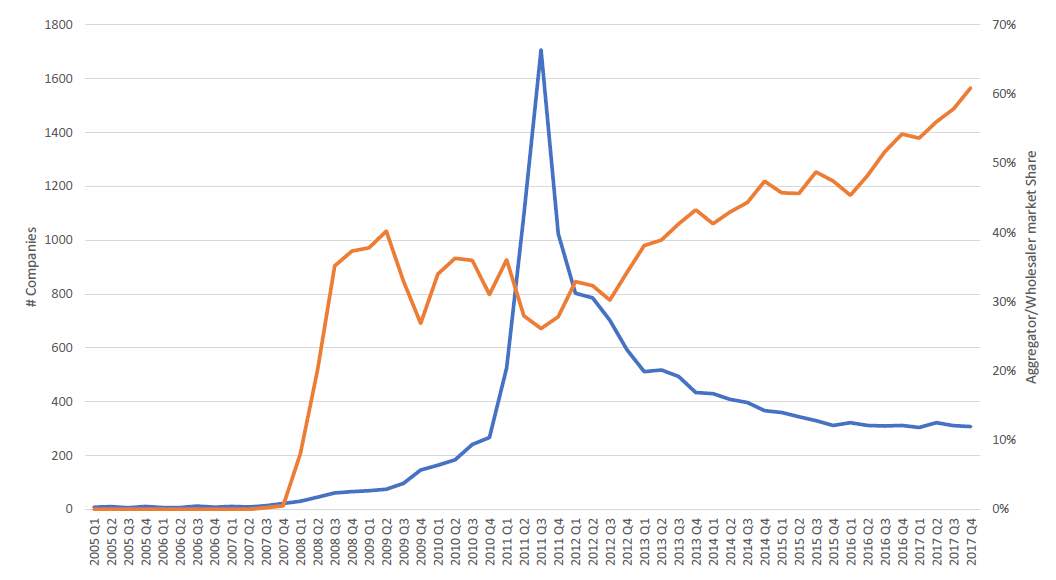

The chart below illustrates (in blue) the number of companies registering STCs in their own name.

At first glance, it is clear that fewer companies (about 300) are self-registering STCs now when compared to 2011, when over 1700 companies or individuals self-registered STCs.

But that was back when it looked like the Clearing House would provide a guaranteed $40 (another disproven myth). Once the dust settled on the SRES there were about 500 businesses registering STCs in their own name – a figure that has since reduced.

But this isn’t a sign of market consolidation but evidence of the market preference to use STC aggregators – businesses like Emerging Energy, Formbay, Greenbank, and Green Energy Trading to name a few.

STC aggregators register STCs on behalf of (typically) small companies and individuals, and their market share has progressively risen since 2011 (orange line) to the point where now 60% of the volume (kW) of the market is run through STC aggregators.

This illustrates that small businesses are collectively doing a lot of volume, just that their STCs are registered using an aggregator.

Further evidence of market de-consolidation is provided in the chart below. It shows the market share of the top companies in each quarter, a market share that declined from 2010-2012, was stable from 2013-2015, and which has declined dramatically in the past two years.

Whereas the top 50 companies held a combined 64% of the market in 2010, they now hold less than 30% market share. The 80/20 rule doesn’t apply either – the top 20% of companies held 45% of market share from 2013-2015; currently the top 20% of companies hold 30% of market share.

So, far from being dominated by a small number of large players, the Australian solar industry is increasingly made up of a large number of very small players.

Why didn’t the predicted consolidation occur? SunWiz believes the following reasons are key predictors for continued high levels of competition

In amongst all the businesses that have failed, there are also plenty of businesses that have done reasonably well, and who were well-positioned to take advantage of 2017’s boom.

These smart businesses invested in their own capability, diversified, differentiated themselves, and sought to hold reasonable profit margins.

What can a solar business do to improve its competitiveness?

Warwick Johnston is the managing director of SunWiz, a board director of the Clean Energy Council, and an Australian representative to the IEA.

This post was published on January 31, 2018 10:45 am

A groundbreaking retail electricity trial is offering to pay customers to curtail their rooftop solar…

Nigel Hancock from community energy group Pingala explains how solar gardens work and whether the…

Albanese government invests another $50.2 million to get solar, energy efficiency and electrification into social…

State confirms rooftop solar subsidies for rental properties to be implemented by end of year,…

NSW Independent Allegra Spender on her plan for permanent energy bill relief and what's missing…

Leading Chinese solar manufacturer breaks efficiency record for silicon solar cells, and unveils upgraded solar…