When it comes to energy storage, Australia has captured the world’s attention and is a testing ground for battery products and sales strategies that will ultimately be rolled out across the world.

SunWiz is currently conducting research that will assist in accelerating the battery market, by helping companies understand the market, successful sales strategies, and key product features.

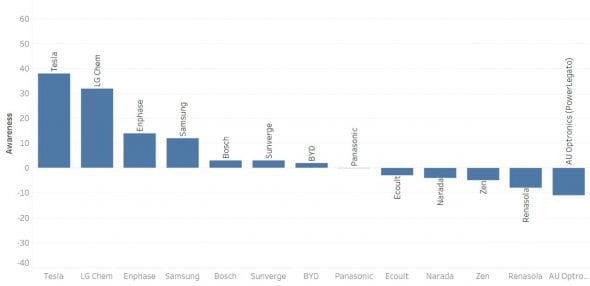

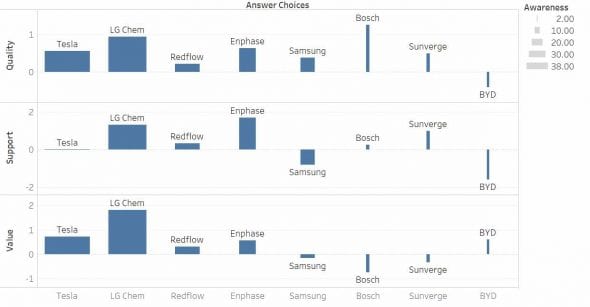

The research typically produces some really valuable insights. For example, some of the results of our retailer survey from 12 months ago are seen below. We surveyed installers on their awareness of various battery brands, and their perceptions of Quality, Value, and Service.

1. The first chart shows the levels of awareness about each battery brand. Tesla and LG Chem are clearly the most recognised brands.

2. The second chart shows installers perceptions of Quality, Support, and Value. The chart illustrates Bosch leading on Quality, followed by LG Chem and Enphase. The company that provided the best support was Enhpase, followed by LGchem. The battery that provided best value was LG Chem.

Since the survey was conducted, a lot has changed – companies such as BYD and Tesla have brought new products to the market, service levels have improved, and prices have fallen.

We’ve also seen new strategies adopted as companies seek to increase their market share. Already there are a wide variety of approaches that are being tested, which can be summarised as:

- Product Approaches: Battery that are compatible with many inverters (e.g. LGchem, Tesla PowerWall1) versus those that combine battery and inverter together (e.g. Sonnen, Enphase, Tesla PowerWall2)

- Channel Approaches: Traditional sales through wholesalers & major retailers (LGchem), versus those that sell direct to small retailers (Alpha-ESS) versus those that sell direct to end-customer (Tesla)

- Service Offerings: batteries are already moving from commodity to a service – e.g. Sonnen’s Flat. Like Sonnen, products such as Redback Technologies can also control loads to optimise self-consumption and battery utilisation.

Each area has rapidly evolved, even over the past six months.

There have already been lessons learned with product design, and 2nd- and 3rd-generation products reflect the lessons learned, as evidenced by the evolution of Redback Technology’s product and Tesla’s integration of an inverter. The clear trend for product design is improved ease of installation. No doubt there will be further product enhancements and differentiation as we go.

Channel strategies are also evolving. The most dramatic change in channel strategy was Tesla directly supplying supplying its PowerWall2, a highly-ambitious strategy that would be channel-killing for any company other than Tesla, and will need to be judged in the long-term.

Meanwhile many retailers are carefully balancing the benefits of being associated with Tesla’s X-factor with the drawbacks of dictated prices with narrow margins and limited supplies.

Some battery manufacturers (e.g. LGchem) are now available through more wholesalers, which erodes wholesaler margins – ultimately a good thing for consumers but a strategy that can also backfire as wholesalers seek out other product (or even create their own).

Perhaps the most visible example of an enhanced service offering is SonnenFlat, whereby customers who have purchased PV & a Sonnen battery can opt to pay no more electricity bills and instead pay a flat service charge.

(Alpha-ESS also had a ‘rent a battery’ service offering). Improved customer support is another area where services are evolving.

Amongst all of this, its clear that the battery market continues to accelerate. Notwithstanding Tesla’s presumed reduction in installation volume in H1-2017 (while everyone awaited the PowerWall2), the message from the rest of the market is that battery sales volumes in H1-2017 have increased significantly over last year’s installation rate, and that the rate continues to grow in H2-2017.

SunWiz is in the process of collating information from wholesalers and manufacturers that will allow us to calculate the market size, and identify emerging trends. We are capturing information on:

- sales conversion rates and what drives sales

- proportions of installations that are

- AC/DC coupled;

- 3-phase

- retrofit

- Perceptions of battery brand quality, support, and value for money

- The value to customers in a range of factors including:

- Blackout protection

- Maximising self-consumption through load shifting

- Managing peak demand

- Good monitoring app

- Cycle life warranty

- Chemistry (Safeness)

- High Power discharge

- Modular

- Weight

- DC vs AC Coupled

- 1-phase vs 3 phase

The Australian energy storage market is in its infancy, and yet remains incredibly opaque. But by collating the collective wisdom of the hundreds of businesses that are selling batteries, we can accelerate the rollout of energy storage across Australia and the world.

Please take part in the research for our mid-year battery market update. Battery retailers are invited to take part in this survey: https://www.surveymonk

Please take part in the research for our mid-year battery market update. Battery retailers are invited to take part in this survey: https://www.surveymonk

Warwick Johnston is the managing director of SunWiz, a board director of the Clean Energy Council, and an Australian representative to the IEA.