Last year I shared an article about how I calculate the break-even point (aka “Return On Investment” or “ROI”) on my family home’s renewable energy system.

My goal was to bring some real-life data to the public discourse about the financial pros and cons of switching to a green home. I wanted to test the received wisdom that making this switch was too expensive and would never pay for itself.

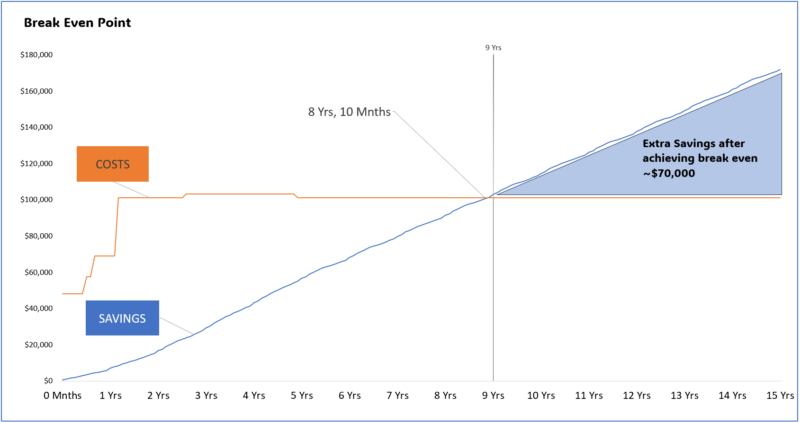

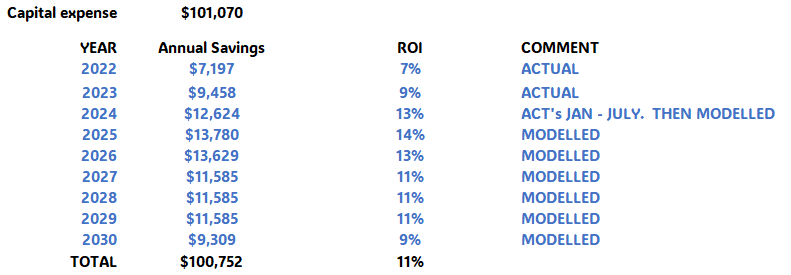

In my article I demonstrated that savings from our investments would fully offset the costs in 8 years and 3 months.

At that time, in September 2023, I had 21 months of data but only 6 months contained the full set of our renewable energy items. We didn’t complete our capital acquisitions until mid-February 2023.

Seasonal variation in solar production is a key factor driving the savings from residential renewables. So I wasn’t entirely sure how the numbers would play-out until I had the complete set-up for an entire year.

Now that I have the data I can offer an update on the ROI for our project.

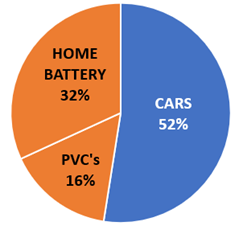

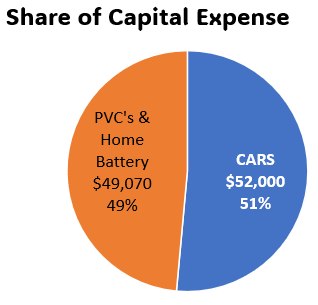

Capital Expense (1 Dec 2021 – 16 Feb 2023)

Cars (Marginal Cost) $ 52,000

Home Battery $ 32,898

Rooftop Solar Array $ 16,172

$101,070

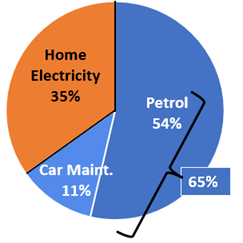

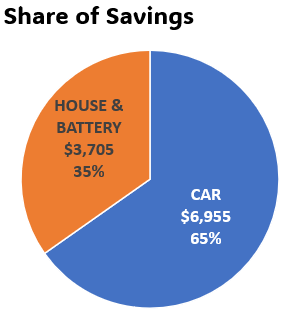

1 Full Year Savings (1 Mar 2023 – 29 Feb 2024)

Petrol $ 5,720

Car Maintenance $ 1,235

Home Electricity $ 3,705

$ 10,660

Our estimated ROI is now 8 years and 10months. This 7 month extension is because I reduced the estimated litres per 100Km for the ICE vehicles in the model. I made this change after further reading on this topic.

Our PVC’s and home battery are rated for 20 years useful live. I fully expect the EV’s to last 20 years as well.

But let’s just say everything is worn-out in 15 years. By then the surplus savings after achieving break even will be around $70,000, which, theoretically anyway, has us well on the way to covering the costs of the next set of equipment.

These annual savings yield an average annual ROI of 11% which is decent, compared to Bank term deposits or stock market returns.

Power Generation and Consumption

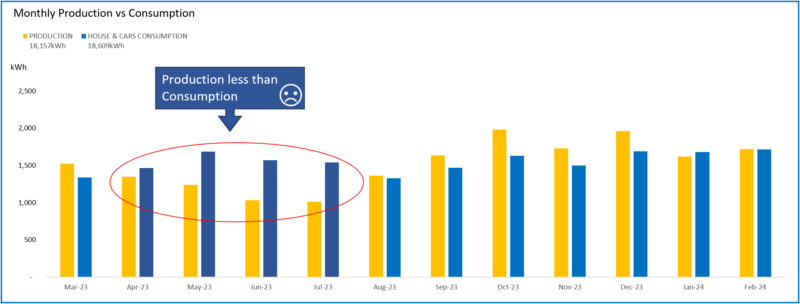

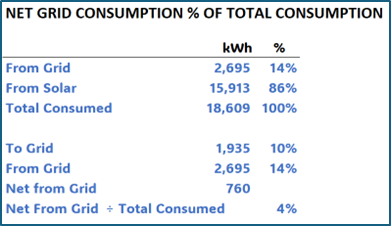

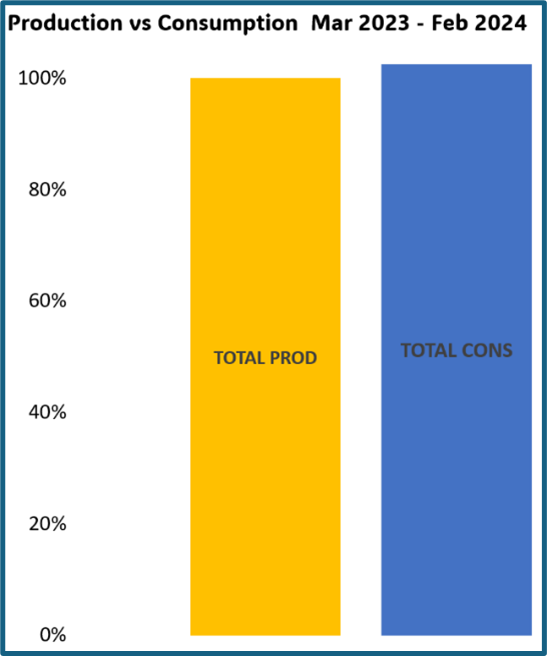

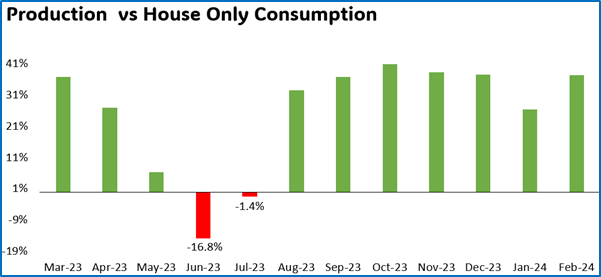

From March 2023 to Feb 2024, we produced 98% of what we consumed. We produced 18,157kWh, and consumed 18,609kWh.

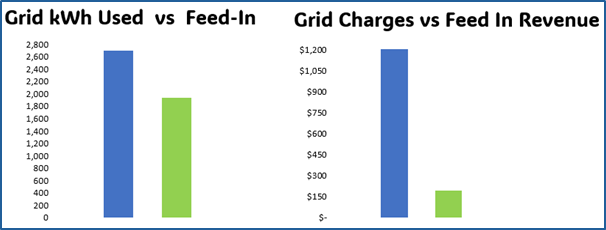

But production was uneven. 8 months of the year we over-produced, sending 1,935kW to the grid, and for 4 months we under-produced, and had to buy 2,695kWh from the grid.

Despite producing 98% of what we used, the power we drew from the grid was 14% of our total consumption.

After adding back the kWh we fed into the grid, our Net Grid Consumption was only 760kWh or 4% of our total consumption.

But the difference between the Feed In Tariff and the Consumption Tariff made it an expensive 760kWh, costing us $1,025, or $1.34 per kWh (vs 29c on our energy plan).

So we’re now looking at ways to minimise the gap between production and consumption in the 4 winter months of the year.

Being smarter about EV charging matters

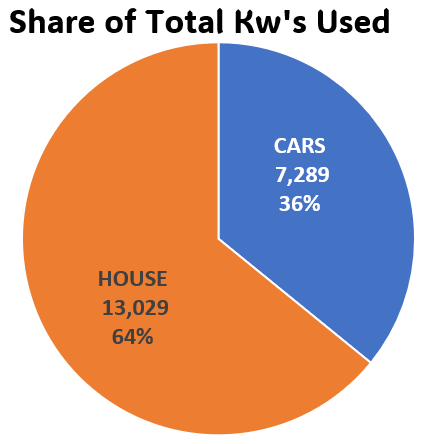

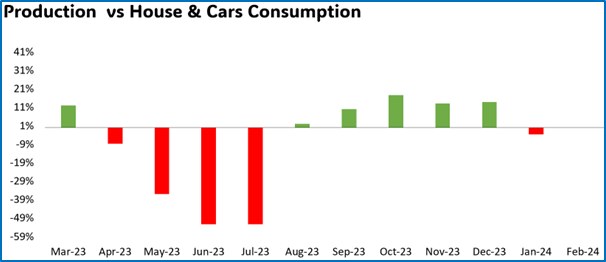

The statistics for our Electric Vehicles show EV’s are critical to achieving a timely break even. They are 52% of our total capital investment, 36% of all consumption (including at superchargers), but 60% of the savings.

The disproportionate share of savings is due to the high costs of petrol and ICE vehicle maintenance. Ironically the more kilometres we drive the better our ROI, even when it increases our use of fossil fuel energy to charge the EVs.

While the EV’s definitely do the heavy lifting on the ROI, they do make it challenging to avoid using fossil fuel power. In the 12months of this case study, without the EV’s our solar production would have easily met our needs, except in June.

But to run the house and charge the EV’s we had to dip into the grid during 5 months of the year.

An unexpected finding

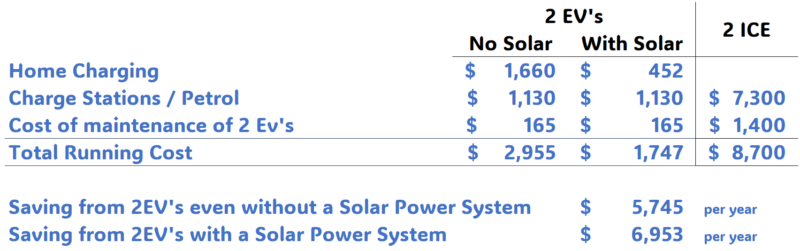

Even if we didn’t have any solar or a home battery, our case study shows it is still financially sound to own an EV rather than an ICE; and that’s without any special electricity plan for EV charging.

The data below come from the March 23 to February 24 period in my data set.

| Petrol (ULP98) Avg cost for the 12 months | $2.10/L |

| ICE Vehicle Fuel Efficiency (Volkswagen) | 8.7L (Volkswagen GTi)

10.2L (Mercedes All Terrain Wagon) |

| ICE Vehicle Maintenance

EV Vehicle Maintenance (Actual) |

$$194 in total for the 2 EVs

$1400 estimated for the 2 ICE |

| Kilometres Travelled (Actual) | 35,879kms in total for the 2 EVs |

In my model I can ‘turn off’ the effect of the solar power and when I do that, based on the conditions above, it shows that even without free power from the sun, our two EV’s would have saved us just under $6000 from March 2023 to February 2024.

It doesn’t have to be a Tesla…

Our daughter recently bought a second hand Leaf, a 2017 model for $21,900. The battery health is a robust 91.6% of the original 40Kw, which gives her the range she needs for her daily commute.

In the first three months, the petrol savings covered around 25% of her monthly car loan repayment.

Lessons Learnt

My case study supports the argument that residential renewables can pay for themselves before they reach end of useful life.

Even if we didn’t have rooftop solar or a home battery the EV’s are a sound investment.

We can still make improvements:

- Move to an energy plan that rewards us for our solar investment

- Charge the cars to 55% instead of 80% which is better for their batteries

- Be smarter about how we use our home battery by using the Time Of Use settings to ensure we always have reserves for the nighttime peak.

A Final Thought

It’s often forgotten in break-even discussions that the annual savings will continue to accrue long after the capital cost has been covered. I will inevitably spend the extra dollars in my local economy where they will do what money does; go round and round.

So I see our transition to renewables as more than just doing my part to reduce carbon emissions. It makes me more able to support local businesses, their employees and their families, whereas buying petrol results in around $37 billion Australian dollars exiting the nation each year.