The results are in for Energy Consumers Australia’s latest survey of households and businesses, a comprehensive and ongoing measure of the attitudes and activity of the nation’s electricity and gas consumers.

The survey yielded a number of interesting results, such as a “considerable” improvement of consumer sentiment that included he highest recorded ratings of value for money of electricity and gas and strong improvements in confidence about future energy market outcomes.

But a couple of other points caught our attention at One Step Off The Grid: The data on which households and where – and in what numbers – were thinking of quitting gas altogether, and; Consumer sentiment on smart meters.

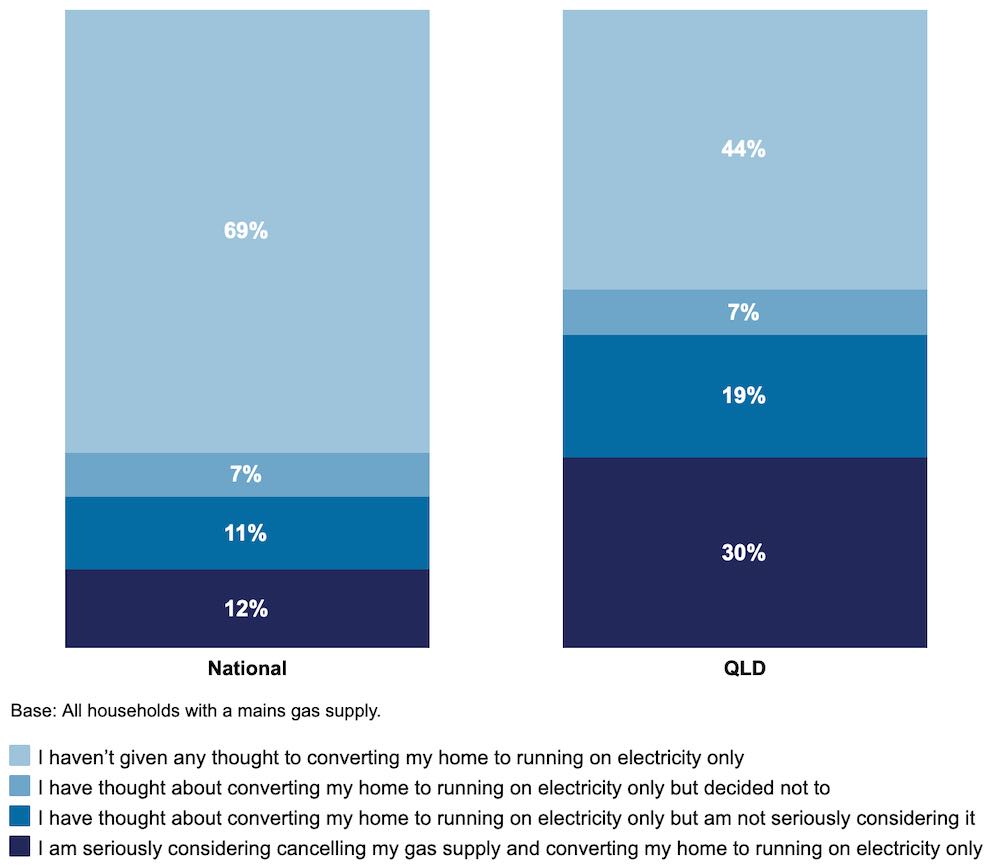

The ECA survey this year noted that some Australian households had been cancelling their gas supply and converting their home to running on electricity only. And it asked respondents whether this was something they, too, had considered – and to what degree.

As One Step has reported, the shift to all-electric homes is becoming increasingly economically attractive – although not always easy or cheap to execute – as gas prices increase, electric appliances become more energy efficient and households install solar.

But just how much traction is the idea gaining? According to the survey, a surprising 31 per cent of household respondents – nationally – were revealed to have at least considered switching off their gas supply and going all-electric, even if they had ultimately decided against it.

Another 23 per cent of respondents, nationally, said they were either seriously considering switching (12 per cent), or were thinking about it, but not particularly seriously (whatever that might mean).

On a state-by-state basis, this more or less reflects the findings across Australia – with the exception of the Sunshine State, Queensland, where an impressive 30% of respondents said they were seriously considering cancelling their gas supply and converting to electricity only.

Another 19 per cent of Queensland household respondent said they had given thought to going all-electric, but weren’t seriously committed to the idea, and 7% said they had thought about it and then decided against it.

So what is it about Queensland that makes households in that state more than twice as likely to go all-electric? It could have something to do with the state’s huge uptake of rooftop solar – and the move by households to boost solar self-consumption as feed-in tariff rates decline.

Further, in Queensland the reticulated (piped) gas network is limited to the state’s south-east and services around one-quarter of the residential customers compared to the gas networks in NSW and Victoria. That leaves a high number of customers using LPG in delivered bottles for their domestic supply, which would offer greater motivation –cost, inconvenience – to quit.

Whatever the motivations, it is interesting to see that it a) the question about quitting gas made it onto the ECA survey, and b) a decent chunk of households have at least given going all-electric some thought.

Which brings us to smart meters. The ECA survey asked households how willing they would be to share their energy usage information with companies, with the goal of providing better products or services that would help save money, or of suggesting products better suited to a household’s needs.

This is an interesting question to ask, because the wholesale shift to smart meters – and the ability to use them as intended, alongside smart inverters – is considered vital to the future running of the grid, with so much energy generation and storage capacity being installed behind the meter. Consumer trust will be a big part of the equation.

So what did people say? As you can see in the chart below, an encouraging 67% of respondents said they would be willing for their data to be shared, but 36% said they would do so with some concerns.

Worryingly, a 21% group said they would not be willing to share their data, while another 12% were unsure – which at least suggests they have not closed their minds to it.

Australia is a laggard on the uptake of smart meters. According to a recent Australian Energy Market Commission consultation paper, just 1.04 million smart meters had been installed across the National Electricity Market (NEM) excluding Victoria by October 2020.

This corresponds to a penetration of 17.4% with a range from 16% in the Australian Capital Territory up to 20% in Tasmania. As RenewEconomy reported at the time, the low numbers prompted the AEMC to announced a review into rules that apply to smart meters, in a bid to stimulate demand that did not emerge after its last suite of reforms.

As well as making our grid much dumber, this failure affects consumers. Data produced by the Australian Energy Regulator showed that the low rate of smart meter uptake had left more than three-quarters of electricity customers on ‘flat rate’ tariffs, depriving households of the option of more flexible peak/off-peak, or time-of-use, tariffs.

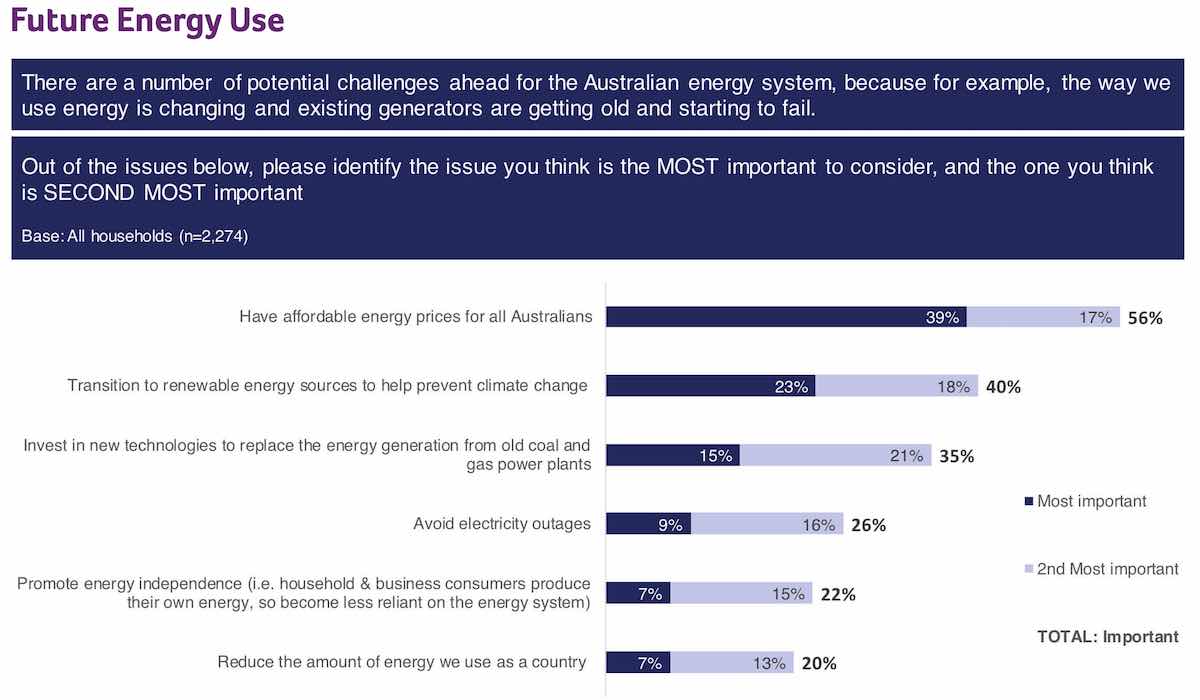

To close, we will leave you with this chart on what Australia’s households and businesses thing about the future of energy supply and consumption. An overall encouraging picture, all things considered.

Sophie is editor of One Step Off The Grid and editor of its sister site, Renew Economy. Sophie has been writing about clean energy for more than a decade.