Two of Australia’s leading commercial solar companies have been snapped up by AGL Energy, in a move that offers both a major endorsement of the booming C&I PV market and the latest sign of a period of consolidation driven by the increasingly tough operating conditions that have been dogging the sector.

As RenewEconomy reported on Tuesday, AGL announced separate deals to buy Solgen Energy Group and Epho in the gen-tailer’s second major push into the rooftop solar market as it plays catch-up on Australia’s rapid transition to distributed renewables.

Australia’s commercial solar market is running hot at the moment, as more and more corporations make commitments and firm plans to source part of all of their energy needs from low-cost and zero emissions renewables.

Despite being the rooftop solar segment hardest hit by the Covid-19 global pandemic, the C&I market still managed to notch up record annual volume of 540MW in 2020, according to industry analysts SunWiz, and a new monthly volume record of 70MW in December.

In among all that record activity, Solgen and Epho have both distinguished themselves: Solgen closing out 2020 as the number one provider by volume; and Epho with its massive Aldi solar rollout and the commissioning of its first “urban solar plant” using its Bright Thinkers Power Station technology.

But behind the record volumes and building corporate solar momentum, 2020 was a tough year for some, including one of Australia’s leading solar commercial solar contracting companies, Todae Solar.

As RenewEconomy reported, Todae went into voluntary administration in July of 2020, a victim of the enormous competitive pressures and the impact on the commercial and industrial market from the Covid-19 pandemic.

In a comment on LinkedIn on Tuesday Todae’s founder, Danin Kahn, welcomed AGL’s acquisition of Solgen and Epho as the “sort of consolidation” that was overdue in a market being buffeted by external factors like declining electricity tariffs and internal factors like declining margins due to pricing pressure and scarcity of repeat business.

“Regardless of market challenges, the industry faces a particular challenge of how and when to scale – and the implications of this are often overlooked by C&I solar companies,” Kahn wrote in an op-ed in late 2020.

“…It begs the question as to why the Australian C&I PV industry is yet to really consolidate to take advantage of the benefits of these economies of scale.”

To this end, things are starting to happen. EnergyAustralia last year moved to take full ownership of solar installer and energy efficiency company Echo Group, in the Hong Kong-owned gen-tailer’s own bid to bolster its share in the Australian commercial and industrial energy services market. And in late 2019, RACV Solar snapped up hugely successful Victorian rooftop solar business, Gippsland Solar.

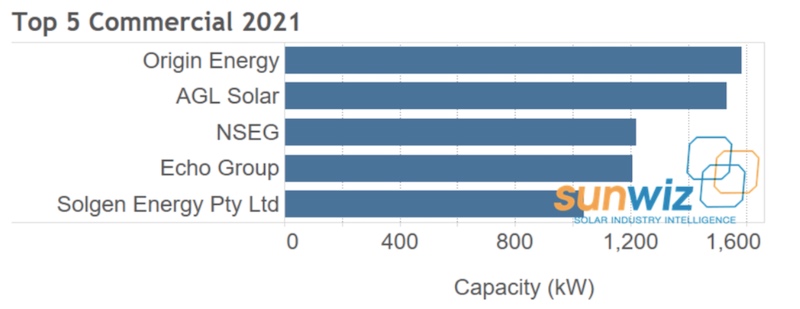

In terms of Solgen and Epho, SunWiz’s Johnston notes that both businesses were – by all visible measures – “great successes.” AGL, meanwhile, itself has been quietly building its own commercial business and currently sits among the top players in the national commercial solar stakes, recently ranking second for 2021, so far, according to SunWiz.

Epho managing director Oliver Hartley told One Step on Tuesday that the acquisition by AGL was “fantastic news” for his company and its small number of private shareholders, giving the specialist large C&I installer the balance sheet to dominate in the sector.

“In the past, you tendered for this project, you tendered for that project… The shift now is to talk about company-wide programs, portfolios, how to manage them and how to get connectivity between assets,” Hartley said.

“Now we can really make that quantum leap into that area of large commercial and industrial rooftops where we’ve estimated there is maybe 30GW of potential, literally untapped.”

Hartley also told One Step that he believes Epho’s Bright Thinkers technology – which aims to establish urban power stations on industrial rooftops – was something that caught AGL’s attention as “a differentiator” in a crowded market, and an edge that AGL needs.

“We are in numerous conversations with clients about further power stations.” Hartley said. “It’s this whole idea of diluting these hard borders,” he added. “In the past, there was behind the meter and there was power stations. Someone like AGL perfectly positioned to do this.”

Solgen, meanwhile, appears to have survived and even thrived, despite an ill-fated and since abandoned 2015 merger with residential solar outfit Mark Group. Anchorage Capital Partners, which bought Solgen in late 2015, said it was proud to have played a part in developing Australia’s largest commercial solar company.

“We are delighted that AGL recognised the strategic benefit of Solgen and look forward to following its continued growth under AGL’s ownership,” said Anchorage chair, Phil Cave.

Solgen Energy Group CEO David Brown said AGL and Solgen Energy Group’s strategies were “well aligned,” offering an exciting opportunity for growth.

“This will allow us to provide more customers with best-in-market commercial energy solutions throughout Australia – this group will play a leading role in the future of the broader, national solar energy market,” Brown said.

Sophie is editor of One Step Off The Grid and editor of its sister site, Renew Economy. Sophie has been writing about clean energy for more than a decade.