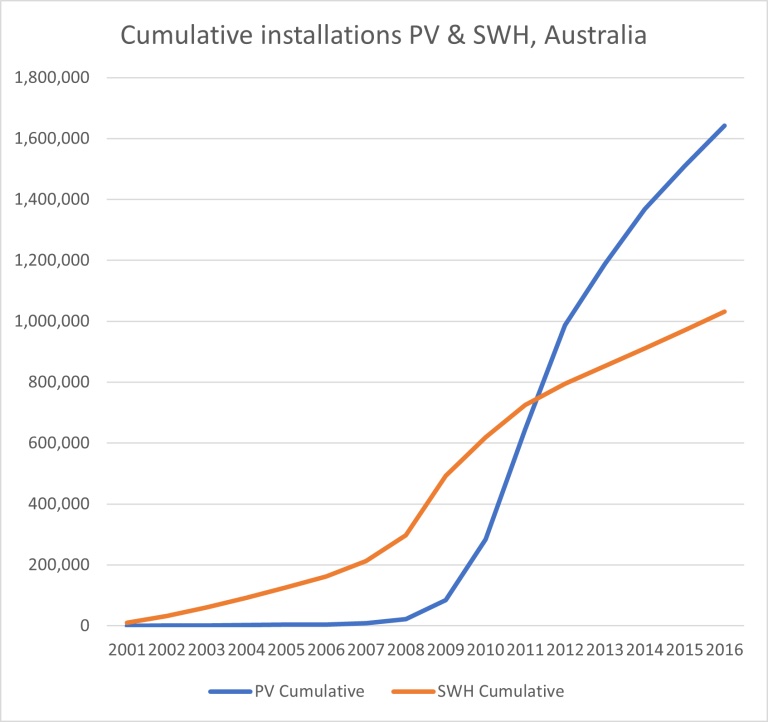

I joined the solar industry at a time when “solar panels” produced hot water, not electricity. That was fair enough: back in 2005, there were 35 Solar Hot Water installations existing for every PV installation.

The year I started SunWiz (2009) was the peak year for solar water heater installations, with 194,000 installations (compared to PV’s 63,000).

The tables turned the following year, when there were three times more new PV installations than there were for solar water heaters.

From that moment forth “solar panels” referred to PV rather than solar hot water.

Air source heat pumps ate the lunch of solar hot water

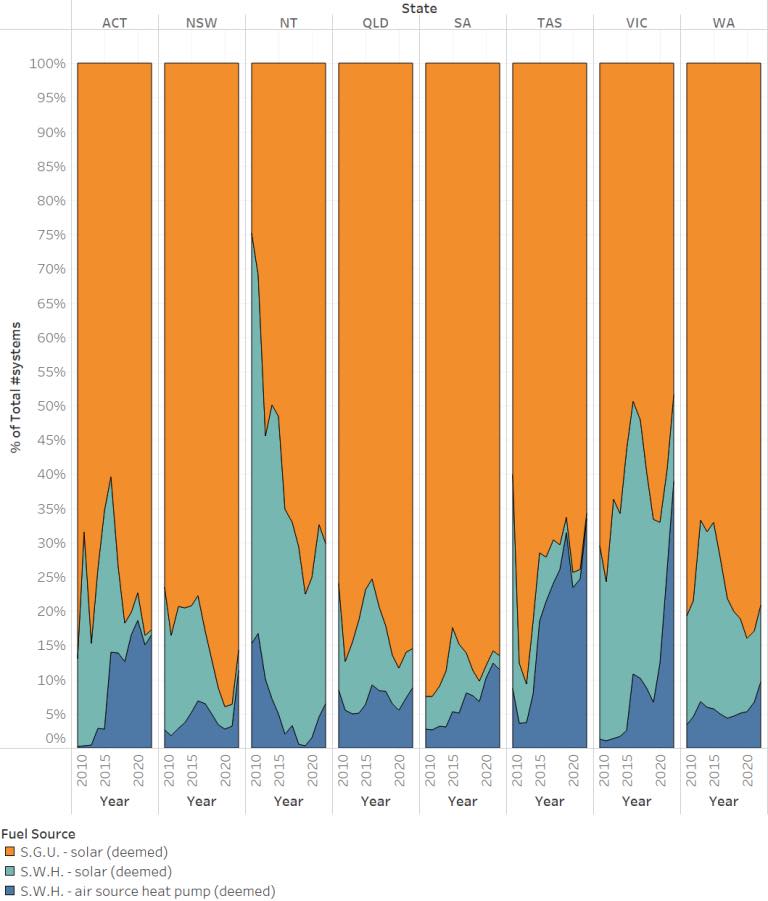

For the purposes of STCs there are two types of solar water heaters – air source heat pumps, and solar hot water systems. Until recent years, air-source heat pumps were an almost immaterial part of that water heating market.

Whereas solar hot water systems have been declining in annual installation volume since 2016, Air Source Heat Pumps have been increasing in volume.

In 2020, air source heat pumps (ASHP) really started to grow in popularity, and solar hot water (SHW) systems saw their sales figures drop considerably.

Air source heat pumps are now eating the lunch of PV

For most of the PV industry, the battle between ASHP and SHW wasn’t of the slightest concern. But then I noticed Victoria had gone from having one of the highest annual PV growth rates in the nation in 2021, to having the lowest growth rate in 2022 (actually the highest contraction rate).

What could explain that?

Well while the Victorian PV figures had contracted heavily, the ASHP figures had grown remarkably, to the point where 57,000 PV installations and 47,000 ASP installations. With SHW added in, more solar water heating systems than PV systems were installed in Victoria in 2022.

The primary driver for the ascendency of ASHPs was the combination of federal subsidy (STC) and state subsidy for ASHP in Victoria (VEECs).

But other states had better take notice. PV systems lost significant market share in 2022 in Victoria, New South Wales and Tasmania; it was only in the Northern Territory and South Australia where PV systems made any gain in market share in 2022.

That’s because an ASHP costs a lot less than a PV system and significantly reduces household energy consumption. When household budgets are stretched, it’s understandable people prefer an ASHP to a PV system.

Of course, an ASHP is most cheaply run using the excess generation from a PV system, (and it doesn’t compete for roof space like solar hot water panels) so consumers should ideally have both technologies.

So if you’re a retailer of a solar power system, you absolutely should be installing ASHP, too.

That will require extending your skillset to plumbing, but ASHP are an inevitable part of household electrification that will require skills in HVAC, EV charging, water heating, and energy storage – plus the IT systems that interact to enable it all to intelligently operate together.

The retailer that manages to do all of the above in some scalable way will be snapped up quickly by a buyer.

Warwick Johnston is managing director of SunWiz

This article was originally published by SunWiz. Read the original version here.