Just weeks after having the brakes slammed on hoped-for large-scale renewable investment, Origin Energy has tipped a further $A530 million into one of the global leaders at the smaller-scale end of the clean energy spectrum, Octopus Energy.

In a statement on Monday, Australia’s biggest utility – which straddles the market as both the nation’s biggest installer of rooftop solar and owner of the biggest remaining coal-fired plant – said it is boosting its share in the UK-based Octopus by 3 per cent to a total of 23 per cent.

And while this relatively small investment pales against the $30 billion Brookfield and co had promised to spend building 14 gigawatts of new wind, solar and storage in Australia over the next 10 years – part of a takeover offer that was unceremoniously rejected by a minority of shareholders two weeks ago – it’s no small thing.

Rather it suggests that Origin might be training its focus on another key piece of the global decarbonisation puzzle – and one that experts say continues to be neglected in Australia by industry and policy makers: home energy electrification and efficiency.

As Origin notes, Octopus is now the UK’s largest electricity retailer and second largest energy retailer, with more than 11 million customer accounts, based on a low-cost operating model and its Kraken platform.

Kraken is Octopus’ software solution based on advanced data and machine learning that promotes energy efficiency and allows customers to access power when it is cheaper and greener – a boon for household bills and for the smoother operation of grid.

As Octopus founder and CEO Greg Jackson told a panel at COP28 at the start of the month, in one day the company had paid more than half a million of its UK customers to use less electricity at peak times.

“It means we can just get rid of all the coal standby. It costs 10 times less than coal to pay consumers. That’s what we did [on that one day],” he said.

“It’s probably the biggest virtual power plant in Europe, maybe in the world. And it’s growing 24 per cent month-on-month in the UK,” he told The Australian Financial Review.

As well as Kraken, the company owns and leases electric vehicles; sells solar panels, EV chargers and smart meters; and increasingly invests in large-scale renewables generation.

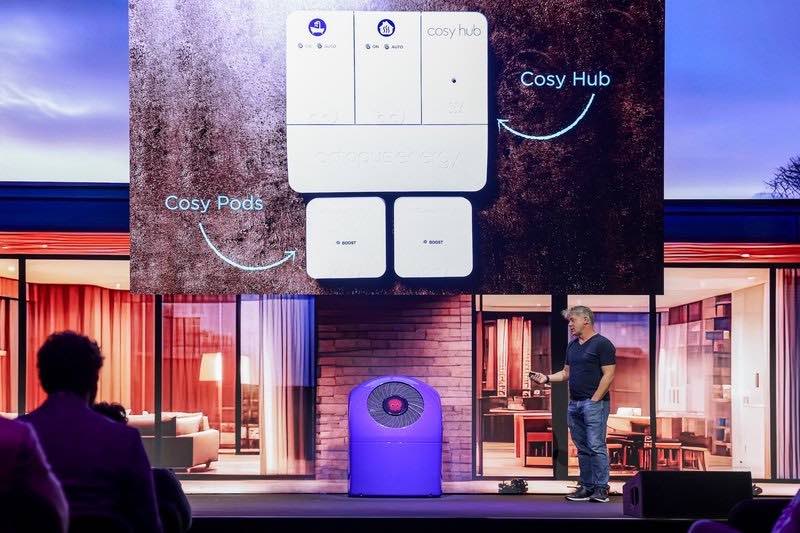

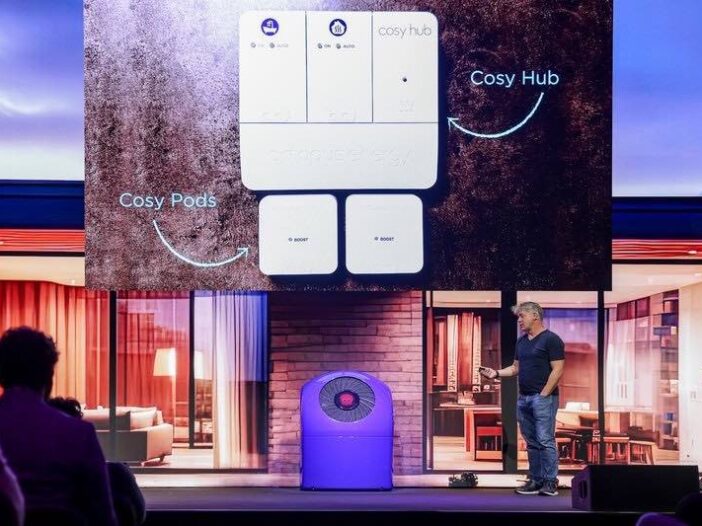

It also sells heat pumps. In September, Octopus UK unveiled a smart home heating system called Cosy Octopus, which consists of a heat pump branded with the company’s distinctive pink cephalopod, a home control system, room sensors – known as “Cosy Pods,” and a bespoke smart tariff.

All of this focus on making home energy smarter and greener is paying off. Since Origin’s last investment in Octopus in 2022, the company has more than doubled its retail customer base, acquiring the UK’s Bulb Energy (2.5 million customer accounts) and Shell Energy’s retail business in the UK and Germany. The company has also delivered significant organic growth, adding 400,000 customers in the past six months.

Origin also notes that the latest capital raising for Octopus – which also attracted further investments from Canada Pension Plan Investment Board (CPP Investments) and Generation Investment Management (GIM) – values the company at £5.6 billion ($A7.8bn) – a roughly 60 per cent increase on the valuation made ahead of the last capital raising in June 2022.

No small part of this market success has come from licensing out its Kraken software to legacy utilities, like Origin, which has spread its use across 52 million customer accounts worldwide – and it wants to roughly double that number by 2027.

“The success of Octopus since our initial investment in May 2020 has exceeded all expectations and cemented our belief in its unique capabilities and strong platform for future growth,” said Origin CEO Frank Calabria on Monday.

“Kraken is contracted to serve more than half of all UK households and is licensed in 10 countries, and it has a strong global sales pipeline due to its ability to rapidly transform business operations and customer experience, which is critical in a rapidly transforming energy system.

“In addition, Octopus has over 1GW of assets connected to its virtual power plant through the Kraken Flex platform, growing at 25 per cent month-on-month since launching in January 2022.

Calabria says the increased interest in Octopus reflects his own company’s confidence strategy “to lead the energy transition” through customer clean energy solutions.

“We continue to believe Octopus provides an important avenue for future growth,” he said.

So, while it might be true to say that $500 million of Origin’s budget tipped into Octopus is yet more money the gentailer won’t be investing in large-scale renewables in Australia, it’s far from a bad bet.

As Rewiring Australia sought to remind following last week’s update on Australia’s renewables outlook from AEMO, a shift in the focus of energy planning to drive electrification and rooftop solar is sorely needed.

“AEMO has moved considerably to embrace the potential of electrification but is yet to catch up with the rooftop revolution led by millions of Australian households,” said the organisation’s co-founder and chief scientist, Saul Griffith.

“AEMO should be thinking outside the box and innovating ways to bring about faster and greater deployment of consumer energy technologies.

“Household energy should be seen as a resource, not a risk and the market redesigned to help consumers reduce bills from their solar, batteries and EVs, which is what these technologies can do.”

Far be it for us to suggest that Origin is thinking this far “outside the box” as one of Australia’s big-three gentailers – particularly on the benefits to consumers bit – but it is at least keeping its finger on the pulse of home solar electrification.

Sophie is editor of One Step Off The Grid and editor of its sister site, Renew Economy. Sophie has been writing about clean energy for more than a decade.